In today’s rapidly evolving digital landscape, the demand for efficient transaction processing and seamless integration of various financial technologies is at an all-time high. One platform that has gained traction in this realm is CCXProcess. This article explores what CCXProcess is, its key features, how it operates, and the potential advantages and challenges it presents to users.

What is CCXProcess?

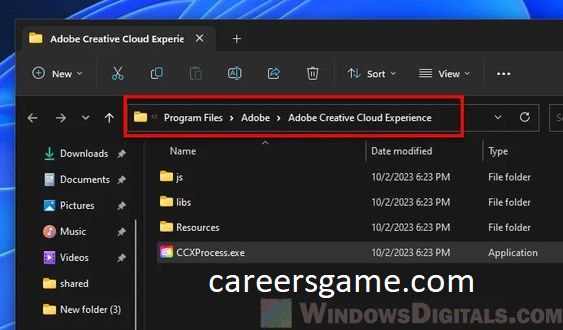

CCXProcess is a payment processing platform designed to facilitate transactions across multiple channels, including online, mobile, and in-person payments. It aims to provide businesses with a comprehensive solution that simplifies payment acceptance, enhances security, and streamlines financial operations. With the increasing complexity of payment systems and consumer preferences, CCXProcess seeks to bridge the gap between businesses and customers, offering an integrated solution that addresses the diverse needs of today’s market.

Key Features of CCXProcess

- Multi-Channel Payment Acceptance: CCXProcess allows businesses to accept payments through various channels, including e-commerce websites, mobile applications, and physical retail locations. This flexibility is crucial for businesses looking to cater to a wide range of customers.

- User-Friendly Interface: One of the platform’s strengths is its intuitive interface, which simplifies the payment processing experience for both merchants and customers. A user-friendly design reduces the learning curve and enhances overall satisfaction.

- Security Measures: CCXProcess prioritizes security by incorporating advanced encryption and fraud detection measures. This focus on security helps protect sensitive customer information and fosters trust in the payment process.

- Integration Capabilities: The platform supports integration with various third-party applications and services, such as accounting software and customer relationship management (CRM) systems. This interoperability allows businesses to streamline their operations and maintain cohesive financial records.

- Real-Time Reporting and Analytics: Businesses can access real-time data on transactions, enabling them to monitor performance and make informed decisions. Detailed analytics can help identify trends, optimize pricing strategies, and enhance customer engagement.

How CCXProcess Operates

CCXProcess functions by providing a centralized platform where businesses can manage all their payment processing needs. Here’s a step-by-step overview of how it works:

- Onboarding: Businesses begin by creating an account on the CCXProcess platform. This typically involves providing necessary information about the business and linking bank accounts for fund transfers.

- Integration Setup: After onboarding, businesses can integrate CCXProcess with their existing systems, such as e-commerce platforms or point-of-sale (POS) systems. This step ensures that payment processing is seamless across all channels.

- Payment Processing: Once set up, businesses can start accepting payments. Customers can make payments using various methods, including credit and debit cards, digital wallets, and bank transfers. CCXProcess handles the transaction, ensuring that funds are securely transferred.

- Reporting and Analytics: After transactions are completed, businesses can access real-time reporting tools. This feature allows them to track sales, analyze customer behavior, and adjust strategies accordingly.

- Customer Support: CCXProcess offers customer support to assist businesses with any issues they may encounter. This support can include troubleshooting payment issues, helping with integrations, and answering questions about platform features.

Advantages of Using CCXProcess

The adoption of CCXProcess can offer several advantages to businesses:

- Increased Efficiency: By centralizing payment processing, businesses can reduce the time spent managing transactions across multiple platforms. This efficiency can lead to better resource allocation and improved operational workflows.

- Enhanced Customer Experience: With the ability to accept payments through various channels, businesses can cater to customer preferences, leading to a more satisfying shopping experience. A seamless payment process can also reduce cart abandonment rates.

- Improved Security: The platform’s emphasis on security measures helps protect sensitive data, mitigating the risks associated with payment fraud. This level of security is increasingly important in today’s digital landscape.

- Data-Driven Insights: The real-time analytics provided by CCXProcess allows businesses to make data-driven decisions. Understanding customer behavior and transaction trends can help optimize sales strategies and improve overall performance.

- Scalability: As businesses grow, their payment processing needs may evolve. CCXProcess is designed to scale with businesses, providing the flexibility needed to accommodate changing demands.

Challenges and Considerations

While CCXProcess offers many benefits, there are also challenges and considerations to keep in mind:

- Cost: Businesses must evaluate the fees associated with using CCXProcess, including transaction fees and subscription costs. These expenses can add up, especially for smaller businesses or startups.

- Integration Complexity: While CCXProcess supports integration with various systems, the setup process can be complex for some businesses. It may require technical expertise to ensure smooth integration.

- Reliability of Service: Like any digital platform, CCXProcess is susceptible to technical issues. Businesses should be prepared for potential downtimes or disruptions that could impact payment processing.

- Customer Support: The quality of customer support can vary, and businesses must ensure they have access to reliable assistance when needed. Inadequate support can hinder operations during critical times.

Conclusion

CCXProcess represents a robust solution for businesses seeking to simplify and enhance their payment processing capabilities. With its multi-channel acceptance, user-friendly interface, and strong security measures, it addresses many of the challenges faced in today’s digital marketplace. However, potential users must carefully consider the associated costs, integration complexities, and reliability of the service.

As the landscape of digital payments continues to evolve, platforms like CCXProcess will play an essential role in helping businesses navigate these changes. By understanding both the advantages and challenges, businesses can make informed decisions that align with their operational goals and customer needs. Ultimately, embracing effective payment processing solutions can pave the way for growth, improved customer satisfaction, and enhanced competitiveness in a dynamic marketplace.